Reverse Logistics in India:Turning Returns into Strategic Advantage

A Guidebook for Supply Chain Professionals.

Every supply chain begins with a promise: deliver the right product, to the right place, at the right time. But what happens when the customer says, “I don’t want it”?

When we think of logistics, we picture goods moving forward: factories to warehouses, warehouses to retailers, retailers to customers. What we don’t see is the silent flow of goods moving backward - items rejected at the doorstep, gadgets returned after a few days of use, or defective products sent back for repair.

That’s where reverse logistics begins - it is the complex process of managing returns, repairs, recycling, and disposal. It’s no longer a footnote. It is a billion-dollar industry in India, reshaping how businesses think about profitability, compliance, and sustainability. For decades, it was treated as an afterthought, a cost of doing business. Today, it is becoming one of the most critical and expensive functions in global supply chains, and a strategic advantage when executed well.

India’s Reverse Logistics Market

Imagine an iPhone shipped to Mumbai. The customer changes their mind at the doorstep. That single refusal triggers an expensive journey: the phone is carried back through multiple warehouses, graded for resale, or sent for refurbishing.

Multiply that by millions of parcels, and you begin to see the scale of India’s reverse logistics challenge.

- In India, nearly one in five e-commerce orders is returned.

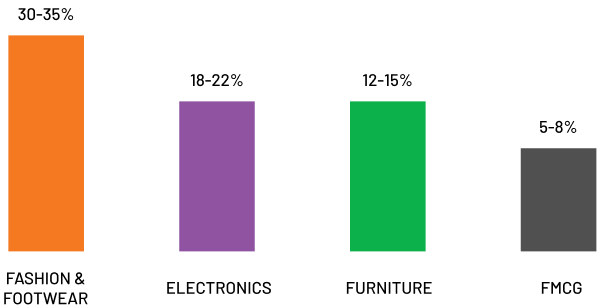

- Fashion returns touch 30-35%, electronics 20%, and COD rejections nearly 26%.

- The reverse logistics market is estimated at $33-90 billion, growing 15-20% CAGR through 2030.

- Processing a return costs up to 1.5x more than the original delivery.

This paper explores India’s reverse logistics landscape, the unique challenges it poses, and the opportunities it creates. It balances technical insights (compliance, cost structures, operational models) with accessible storytelling (case studies, frameworks, global comparisons).

The goal:to help businesses transform reverse logistics from a cost burden into a strategic advantage.

Why Reverse Logistics Matters Now

Logistics in India has historically focused on moving goods forward — from factory to warehouse to consumer. But consumer power has shifted. With the rise of e-commerce, omnichannel retail, and stricter environmental rules, the return journey is just as important as the delivery.

Returns are no longer rare exceptions. They are structural features of modern commerce.

- Customers expect “no-questions-asked” returns.

- Regulators demand take-back programs for packaging, electronics, and batteries.

- Investors evaluate companies on their ESG (Environmental, Social, Governance) performance, where waste recovery plays a key role.

In other words, reverse logistics is where customer trust, regulatory compliance, and sustainability converge.

Defining Reverse Logistics

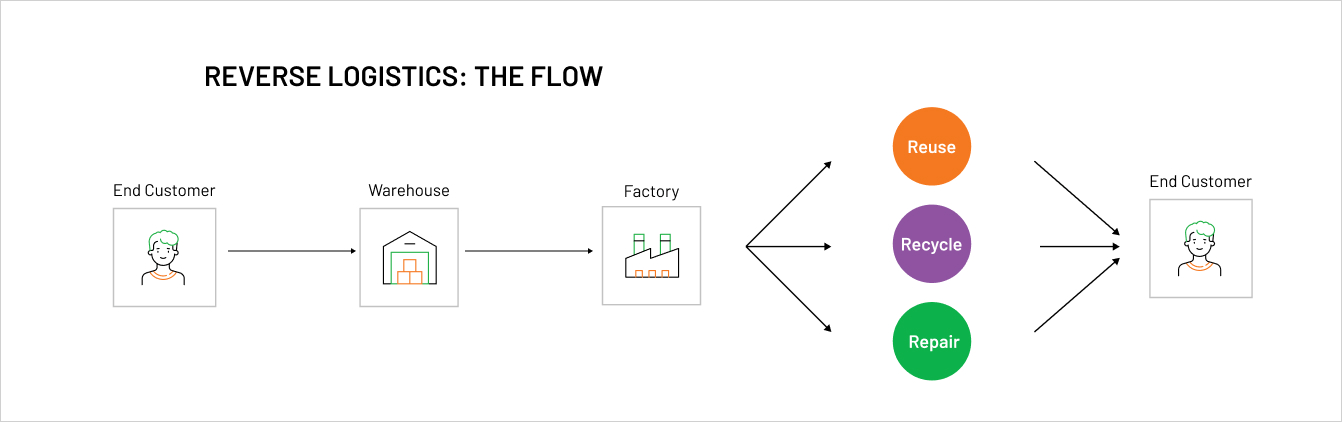

Reverse logistics encompasses all activities related to products moving backward through the supply chain. Simply put, reverse logistics is everything that happens after a customer decides not to keep a product.

- Returns & Exchanges: Products sent back by customers.

- Repair & Refurbishment: Restoring defective products for resale.

- Recycling & Disposal: Handling items at end-of-life safely and sustainably.

- Re-commerce: Reselling used or returned products in secondary markets.

Unlike forward logistics - linear, standardized, predictable, and scalable - reverse logistics is variable, costly, fragmented, and often opaque. Each return is a small puzzle: What is its condition? Can it be resold? Must it be recycled? Should it be scrapped?

Mapping India's Reverse Logistics Landscape

Return Rates, Market Size & Growth Potential

Reverse logistics in India is shaped by unique local dynamics:

- E-commerce explosion: From $46B in 2020 to over $75B in 2024 (IBEF).

- Cash-on-delivery culture: Nearly 26% COD orders rejected, vs <2% prepaid.

- Informal recycling sector: Unorganized players handle nearly 90% of e-waste.

- Urban-rural split: Tier-2 and Tier-3 cities drive growth, but returns infrastructure lags behind.

CATEGORIES WISE E-COMMERCE

RETURN RATE (INDIA 2024)

Market size: $33B-$90B (depending on inclusion of recycling/re-commerce).

Growth:15-20% CAGR projected till 2030.

Environmental Dimension:

- India generated 1.25 million tonnes of e-waste in FY24, projected to hit 1.40 million tonnes in FY25 (CPCB data).

- New EPR (Extended Producer Responsibility) laws mandate companies to take back and recycle electronics, batteries, and packaging.

Bottom line: Reverse logistics is no longer optional. It is central to compliance, ESG goals, and profitability.

Why Reverse Logistics Is So Challenging

- Unpredictability - The true condition and verified availability of returned goods often remain uncertain.

- Cost Spiral - Handling, inspection, repackaging, and redistribution cost more than forward delivery.

- Fraud & Abuse - COD refusals, fake returns, and product swaps inflate losses.

- Compliance Pressure - Extended Producer Responsibility (EPR) rules on electronics, plastics, and packaging.

- Customer Expectations - Refunds must be fast, or brand loyalty suffers.

Business takeaway: Reverse logistics is not just a supply chain issue — it is a finance, compliance, and customer loyalty issue.

Smarter Strategies Emerging in India

Forward-looking companies are turning reverse logistics from a cost centre into a value centre.

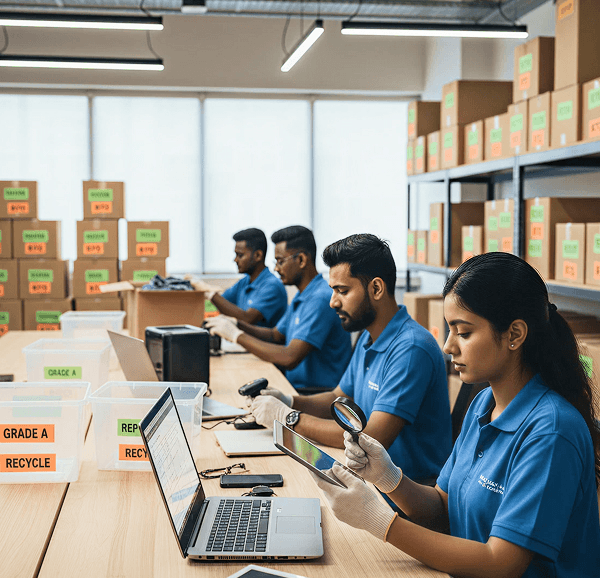

- Dedicated Returns Hubs — Inside modern warehouses — with repair benches, testing labs, and recycling rooms.

- Tech Integration - Returns management systems integrated with order and warehouse platforms; enabling instant refunds and fraud checks.

- Customer Nudges - Incentives for prepaid orders to reduce COD losses.

- Re-commerce Platforms - Cashify, Amazon Renewed, Flipkart 2GUD. Open-box resale, refurbished sales, liquidation rails forming the secondary market.

- Green Logistics - Partnerships with recyclers for EPR compliance and ESG branding. Licensed recyclers, digital certificates, auditable disposal for built-in compliance.

- Smarter networks: Metro hubs with smaller spokes in Tier-2/3 cities.

Global Lessons, Indian Innovations: Case Studies - Lessons from Practice

Case Study 1: Flipkart’s Open-Box Returns (Electronics)

High rate of smartphone returns due to DOA (dead on arrival) units and customer distrust in packaging integrity.

Introduced open-box delivery in key metros: customers inspect and confirm the product before accepting delivery.

- Reduced post-delivery return rate by ~15–20% in pilot cities.

- Improved trust in high-ticket categories.

- Reduced reverse logistics costs at source (doorstep).

Prevention at doorstep is more cost-effective than processing returns downstream.

Case Study 2: Amazon India’s “Amazon Renewed” Program

Millions of returned or unsold electronics carried residual value but lacked a trusted resale channel.

Built Amazon Renewed platform with certified refurbishers: devices undergo data wipe, quality checks, and resale with warranty.

- Recovered 30-40% of value from returned electronics.

- Created a trustworthy secondary market for refurbished devices.

- Reduced e-waste and aligned with India’s EPR obligations.

Certified refurbishment + resale captures margin, improves sustainability, and strengthens brand reputation.

Case Study 3: Cashify and the Refurb Smartphone Market

India generates millions of used/returned smartphones annually; informal resale dominated, creating trust and quality concerns.

Cashify built an organized refurbishment and resale platform: device grading, data wiping, warranty-backed resale; expanded into Tier-2/3 cities.

- Achieved triple-digit growth in refurbished smartphone sales (2023-24).

- Formalized refurb value chain with warranties and quality guarantees.

- Extended device life cycles while cutting e-waste footprint.

Organized refurb players can turn e-waste into opportunity, marrying customer trust with circular economy goals.

E-Waste: The Environmental Side

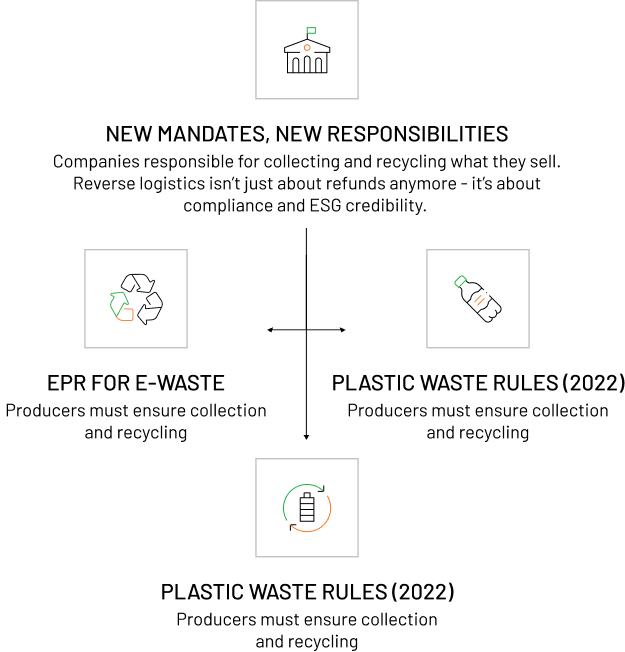

New government rules now make companies responsible for collecting and recycling what they sell. For many businesses, reverse logistics isn’t just about refunds anymore - it’s about compliance and ESG credibility.

- EPR for e-waste: Producers must ensure collection and recycling.

- Plastic Waste Rules (2022): Extended responsibility for packaging waste.

- Battery Waste Rules (2022): Obligations for take-back and recycling.

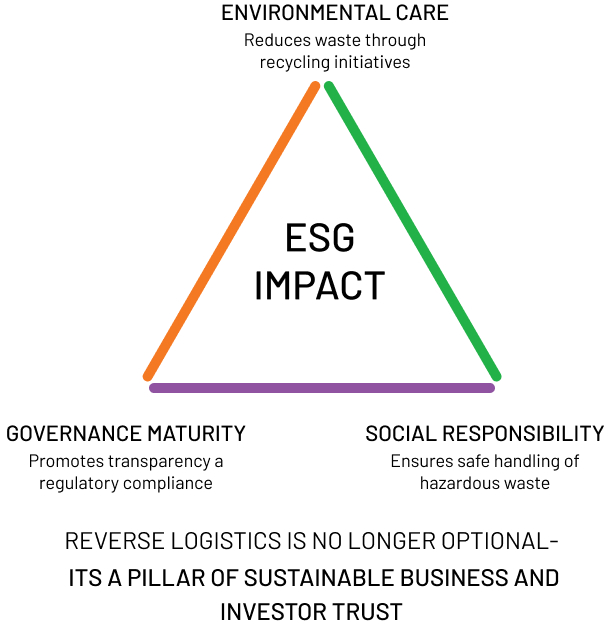

For ESG-conscious investors, reverse logistics demonstrates:

- Environmental care(reduced waste, recycling).

- Social responsibility (safety in handling hazardous waste).

- Governance maturity (compliance transparency).

Category Wise E-Commerce return Rates (India, 2024)

Looking Ahead: The Future of Reverse Logistics in India

India is scaling logistics infrastructure at record pace. In 2024, the country leased 39.5 million sq ft of new logistics space (CBRE India). These modern parks now dedicate entire zones to reverse logistics - a sign of the shift from back-office chore to strategy.

By 2030:

- Returns will rise with more online shoppers.

- India will generate 2 million tonnes of e-waste annually.

- Re-commerce platforms will become mainstream.

- Logistics parks will routinely include reverse hubs.

- ESG will make reverse logistics a boardroom priority.

- Companies will compete not just on how fast they deliver - but how fast they take back.

Conclusion: From Liability to Leverage; From Cost to Competitive Edge

Reverse logistics is not just about handling returns. It is about building resilience in supply chains, winning customer trust, meeting compliance, and unlocking new revenue streams.

Reverse logistics, today is:

- A customer loyalty driver (fast refunds, trust).

- A profit lever (recovering 30-40% value via resale/refurb).

- A compliance necessity(EPR, waste rules).

- A sustainability story (reduced landfill, circular economy).

For Indian businesses, the question is not whether reverse logistics matters - but whether they will treat it as a cost or as a competitive edge. Reverse logistics is turning out as the new engine of supply chain success.

References

Market & Returns

https://www.imarcgroup.com/india-reverse-logistics-market

https://www.grandviewresearch.com/horizon/outlook/reverse-logistics-market/india

https://economictimes.indiatimes.com/.../articleshow/112142214.cms ;https://www.indiaretailing.com/2024/08/18/...

https://mediabrief.com/shipnotes-reveals-26-rto-rate-on-cod-orders-across-india/ ;https://retail.financialexpress.com/news/cods-are-the-single-biggest-contributor...

https://redseer.com/reports/indias-festive-e-commerce-market-2024/

Compliance & waste

https://www.pib.gov.in/PressReleseDetailm.aspx?PRID=2155124

https://www.grandviewresearch.com/horizon/outlook/reverse-logistics-market/india

https://economictimes.indiatimes.com/.../articleshow/112142214.cms ;https://www.indiaretailing.com/2024/08/18/...

https://mediabrief.com/shipnotes-reveals-26-rto-rate-on-cod-orders-across-india/ ;https://retail.financialexpress.com/news/cods-are-the-single-biggest-contributor...

https://redseer.com/reports/indias-festive-e-commerce-market-2024/

Market & Returns

https://www.imarcgroup.com/india-reverse-logistics-market

https://www.grandviewresearch.com/horizon/outlook/reverse-logistics-market/india

https://economictimes.indiatimes.com/.../articleshow/112142214.cms ;https://www.indiaretailing.com/2024/08/18/...

https://mediabrief.com/shipnotes-reveals-26-rto-rate-on-cod-orders-across-india/ ;https://retail.financialexpress.com/news/cods-are-the-single-biggest-contributor...

https://redseer.com/reports/indias-festive-e-commerce-market-2024/

Market & Returns

https://www.imarcgroup.com/india-reverse-logistics-market

https://www.grandviewresearch.com/horizon/outlook/reverse-logistics-market/india

https://economictimes.indiatimes.com/.../articleshow/112142214.cms ;https://www.indiaretailing.com/2024/08/18/...

https://mediabrief.com/shipnotes-reveals-26-rto-rate-on-cod-orders-across-india/ ;https://retail.financialexpress.com/news/cods-are-the-single-biggest-contributor...

https://redseer.com/reports/indias-festive-e-commerce-market-2024/

Market & Returns

https://www.imarcgroup.com/india-reverse-logistics-market

https://www.grandviewresearch.com/horizon/outlook/reverse-logistics-market/india

https://economictimes.indiatimes.com/.../articleshow/112142214.cms ;https://www.indiaretailing.com/2024/08/18/...

https://mediabrief.com/shipnotes-reveals-26-rto-rate-on-cod-orders-across-india/ ;https://retail.financialexpress.com/news/cods-are-the-single-biggest-contributor...

https://redseer.com/reports/indias-festive-e-commerce-market-2024/

DATA & STATS:

- India RL market size: US$33.2B (2024) → US$57.5B by 2033, ~6.3% CAGR (IMARC). Imarc Group

- Alt India estimate: US$90.7B (2024) → US$387.3B by 2033 (Grand View Research). Grand View Research

- India return rates: ~17.6% overall; <33% fashion/footwear (Return Prime study reported by ET/IndiaRetailing). The Economic TimesIndia Retailing

- RTO gap by payment type (2025): ~26% on COD vs <2% prepaid (ShipNotes report; FE Retail). MediaBriefFE Retail

- Festive spike: ~US$14B GMV in 2024 festive season, +12% YoY (Redseer). Redseer Strategy Consultants

- E-waste generated (CPCB/PIB): ~1.25M tonnes in FY24; ~1.40M tonnes in FY25 - context for EPR volumes. Press Information Bureau+1

- E-Waste (Management) Rules, 2022 in force since Apr 1, 2023 (MoEFCC/PIB) and CPCB FAQ 2024. Press Information BureauCentral Pollution Control Board Battery Waste Management, 2022 and CPCB EPR battery portal for compliance flows. eprbattery.cpcb.gov.in+1

- Infra tailwinds for reverse nodes: I&L leasing record 39.5 mn sq ft in 2024 (IBEF citing CBRE; CBRE report).